PREFACE

Australia’s housing market over the past thirty years has seen property become progressively less affordable, characterised by house price growth which has not been reflected by corresponding growth in income levels. This report concerns housing affordability: a major macroeconomic issue in Australia as it is correlated to a substantial build-up in household debt and significant difficultly for first-home buyers and others trying to save enough money for a deposit on a house. Since 1987, the house price to income ratio – a key indicator of housing affordability – has increased by approximately 280% (Figure 1).

Additionally, the house price to income ratio has increased over 25% since the first- quarter in 2014 (ABS, 2017). Such unaffordability is particularly prevalent in Sydney and Melbourne, which both have the highest house price to income ratios in Australia and are the two most populated cities.

Negative gearing refers to the shortfall between mortgage repayments and rental income (Different, 2022). Current policies allow property investors to deduct this shortfall from their taxable income amount, thus reducing their income tax owed. This tax concession incentivises investors to buy property and rent it out, increasing demand and thus prices.

Another tax concession relevant to property is the capital gains tax discounts. The capital gains tax refers to the tax on the sale of capital assets, such as a house. Current policy allows for 50% of the profit upon selling an asset (which has been owned for 12 months or more) to be discounted from the payable income tax amount. Likewise, this discount also provides investors with an incentive to buy property which may increase demand and prices.

This article primarily discusses amendment of the current policy regarding negative gearing tax concessions, as well as other relevant policies, in relation to improving housing affordability in Australia.

CURRENT DATA

As mentioned, housing affordability is commonly measured using a ratio of house prices to income as an Australia-wide mean or median (ABS have used a combination of both). An increase in this ratio demonstrates that home-buyers will have to work and save for longer to be able to afford a deposit on a house. Figure 1 (previous page) shows the increase in house price to income ratio from 1987 to 2017, plotted against the mortgage rate (primarily determined by the Reserve Bank of Australia’s RBA interest rate). Changes to the interest rate are shown to be inversely correlated to house prices, which indicates that changes to monetary policy such as increasing the interest rate may also be prospective methods of decreasing house prices, making housing more affordable. Figure 1 also shows that the upward trend of this ratio has been particularly prominent since 2012-13. Figure 2 analyses the trend in house price to income ratio since 2014. An increase in the ratio of 25.1% is shown to have occurred between the first-quarter of 2014 and the third-quarter of 2017.

Another measure of housing affordability is the house price to CPI ratio. This ratio shows the relationship between house prices and price levels. Figure 3 shows that the rise in house prices has exceeded the increase in general price levels in the economy since 2005. This demonstrates that the average cost of housing has increased at a far greater rate than the average cost of general household goods and services in Australia.

House price to income ratios are particularly high in Sydney and Melbourne as demonstrated in Figure 4. The notably large increase in prices in Perth during the 2004 – 2007 period are attributable (to some extent) to the mining boom (Kusher, 2017). Sydney’s ratio is said to be at approximately 9.3, and Melbourne 8.4, significantly above the nation-wide average ratio of ~6.2 (ABS, 2017). Both cities have been subject to very high levels of house price growth likely due to significant inward migration/population growth and a high level of investor demand. The annual population growth rate for Sydney is 63% higher than Australia’s annual population growth rate, and Melbourne’s is 129% higher (ABS, 2017), increasing the demand for housing and the demand for rental properties, thus encouraging investment activity in the property market.

Figure 5 shows that currently household debt is almost double of disposable income (remaining income after tax deductions), which is a record-high in Australia. ‘New series’ is inclusive of debt in self-managed super funds, whereas ‘June 2017 Series’ is not. Figure 5’s cumulative trend has closely followed Figure 1 (the Australia-wide house price to income ratio) and shows that high house prices may be a possible future economic issue as well as a current affordability issue. This is due to a high risk of default associated with increased debt, which will prospectively significantly rise when the RBA increases interest rates (as predicted to occur during 2018), given all home owners with variable rate loans will have a higher interest rate on their mortgage. Higher rates on mortgages correspond with an increase in household debt. Figure 6 shows the relationship between RBA interest rates and variable rate home loan rates.

As displayed in Figure 6, the real interest rate (RBA interest rate adjusted for inflation), the RBA interest rate and the mortgage rate’s trends since 1991 are very closely correlated.

Increased household debt may have significant adverse effects on the economy in the future, which is discussed further.

ECONOMIC ISSUES

Existing Issues. The very high house price to income and CPI ratios display the unaffordability for housing. First-home buyers who are required to fund a deposit generally out of salary/wages and do not already own a house to sell at the current high prices are greatly affected by housing unaffordability. Other people moving from regional areas into larger cities are also greatly affected as the sale of their previous house would not have sold at a price as comparatively high as purchasing a house in a large or capital city. Generally, people who do not currently own a house in a city, particularly Sydney or Melbourne, and are looking to buy one in a city are most affected by the current housing affordability situation in Australia.

Whilst a solution to this may be for this demographic of Australian’s to live in regional or rural areas rather than big cities, it is often impractical for people as the places with more affordable housing do not offer the desired lifestyle or employment opportunities for them. Therefore, the primary aim of the negative gearing adjustment proposal, or any other policy amendment, is to decrease house prices in larger or capital cities.

Although it may appear that output is not being adversely affected due to the high activity and price levels in the housing sector, Rahman (2008) suggests people who are saving for a deposit for on a home have the tendency to spend less of their disposable income. For example, although it is important to be detailing your car regularly, many consumers are foregoing this along with many other important basic expenditures. This leads to a decrease in consumption and thus economic activity from people saving for a deposit.

However, despite people requiring an increasingly higher deposit on homes, Australia’s household saving ratio is currently at 2.7% of disposable income (fourth quarter 2017), which is low in comparison to other countries such as UK (5.3%), USA (3.4%), Canada (4.2%) and Germany (10.2%). Whilst low savings rates may correspond with high consumption currently, it also increases the risk of sharp decreases in economic activity in the future (Garner, 2006).

Prospective Issues. The current data is also indicative of a possible overvaluation of the housing market. The house price to income ratio is often used by economists to determine whether a property market is overvalued. It has been estimated that, due to Figure 1 and Figure 4, the Australian housing market is overvalued by ~38% (Dales, 2017), Sydney’s market is overvalued by ~155%, and Melbourne’s by ~115% (Onselen, 2017). If house prices relative to average incomes continue to increase at the current rate or higher, the market will become more overvalued.

An overvalued market will eventually return back to its long-term average value due to the theory of ‘mean reversion’. Therefore, house prices will at some stage drop significantly. Without proficient policy changes, this drop may occur very quickly and cause the economy to effectively ‘crash’. This occurred in the UK and USA following the Global Financial Crisis (GFC) in 2008, where overvalued house prices returned back to the regression line in Figure 7 and Figure 8 (displayed in the green circle on each graph).

Mean reversion in the property market occurred as a result of an economic collapse in 2008 in the aforementioned countries.

A rapid decrease in house prices (due to the market’s overvaluation causing mean reversion) is predicted to cause a serious decrease in aggregate demand in the economy, worsened by high household debt (Figure 5), and possibly an economic recession for multiple reasons. Home-owners will have less disposable income to use as they will be paying off their increased household debt, and thus spend less money consuming. Furthermore, Fry, et. al., (2009) conducted research which demonstrated that the substantial devaluation of people’s homes makes them less inclined to spend, as they feel less wealthy. Likewise, this leads to decreased consumption. A significant fall in house prices may cause many people to end up with negative equity, a situation where they owe more than the value of their house. This considerably increases the probability of mortgage default, leaving lenders with a higher proportion of non-performing loans. As a result, banks and other lenders have less capacity to lend to businesses or prospective property buyers. This would predictably have a large-scale negative effect on the economy.

POLICY AMENDMENTS

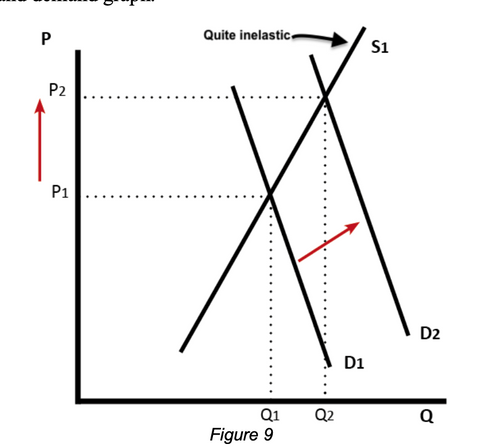

A number of policies could be amended to possibly reduce house prices. These include reducing negative gearing tax concessions, reducing capital gains tax discounts, assistance on deposit savings for first home buyers and increasing the RBA interest rate. Most plausible policy alterations involve a decrease in demand (particularly investor demand in this report) leading to a decrease in price levels, as per Figure 9. Due to the nature of housing (whereby price levels have a minimal effect on supply) and state and local government laws on land release for residential use, supply is said to be inelastic (is not altered by price changes). Figure 9 shows a supply and demand graph.

The capital gains tax (CGT) discount is currently at 50% (33.3% for superannuation funds, see introduction for explanation). On the sale of a house that is considered the sellers ‘main place of residence’, whereby the seller has lived there for three consecutive months in the past twelve months before sold, and was not rented out during ownership, the seller is exempt to the CGT. Therefore, a reduction in the CGT would not affect most home owners, but rather owners of investment properties. Wood & Daley (2016) suggest reducing the CGT to 25%, as it would also raise an estimated $3.7 billion for the federal government, which is currently forecasted to be at a deficit of $29.3 billion this year, and increase housing affordability.

The government introduced the First Home Super Save (FHSS) scheme in the 2017-18 budget. This scheme permits Australian’s who have never owned property in Australia and who intend on purchasing a house for living purposes to use their voluntary and non- concessional superannuation contributions to help purchase a home. Contributions cannot be released before the next financial year (1 July 2018), so the economic effects of this scheme cannot be assessed yet. A potential issue is that it will increase the demand for housing without increasing supply (unlike other policies such as reducing CGT discounts and negative gearing tax concessions with decrease demand). This may further increase house prices and exacerbate the housing affordability issue. Furthermore, this reduces amount of super saved for retirement

purposes for users of the FHSS scheme, which carries long-term adverse implications economically for Australia and financially for these people.

The RBA governs monetary policy and hence sets the interest/cash rate (reviewed monthly). Low interest rates generally correspond with low home-loan rates, which incentivise property purchasing thus increasing demand. Given the interest rate is at an all-time low, this is reflected by a substantially high demand for property. As Figure 9 suggests, this high demand for property deriving from very low interest rates is likely attributable to high prices. Figure 1 also demonstrates this. Increasing the interest rate could therefore decrease demand and prices, although the increases would have to occur in small increments over time as one large increase may cause an abrupt major decrease in economic activity. This may be due to many reasons, such as significantly less demand for housing, increased household debt, and other reasons outlined on page 7 of this report (prospective issues). Economists suggest that gradual increases in the interest rate of 25 basis points or 0.25% would relatively maintain economic stability. It has been predicted that this will occur during 2018.

Reducing negative gearing tax concessions would prospectively minimise the incentive for the purchase of investment properties; an activity particularly common in capital cities. Current policy allows owners of investment properties which are making less return than the interest repayments and outgoings for that property to offset their losses against their other income earned, and as a result, reducing their taxable income. Such reductions also lower income tax receipts, which does not assist the current budget deficit circumstance. Reductions in the concessions (similar to reductions in CGT discounts) would be beneficial to the government’s budgetary position.

This scheme encourages the purchasing of investment properties. An increase in the purchasing of investment properties decreases the supply of housing available to purchase and thus increases the prices (see Figure 9). Hence, reducing negative gearing tax concessions would likely decrease the number of investment properties purchased and consequently decrease the price. Given most investment properties are in capital cities, particularly Sydney and Melbourne, this would especially decrease prices in areas where the house price to income ratio is highest and housing is least affordable.

Rather than abolishing it, a reduction of negative gearing tax concessions to allow only 50% of losses to be deducted from income tax may be appropriate. By doing this, economists can then determine whether such policy changes have improved housing affordability, and then make an informed decision on whether to make further decreases or entirely abolish the scheme. Gauging a decrease in the tax concessions effect on the economy is important as it may have negative effects such as increasing mean rent prices as landlords will have to ensure the property is not negatively geared. Therefore, this policy amendment may adversely affect owners of investment properties (generally middle to high income earners) and renters (generally middle to low income earners). Owners of investment properties would also have to pay more income tax and this would decrease their disposable income (as well as retirement funds). A decrease in disposable income would reduce consumption and therefore have a deflationary impact on the economy and decrease economic activity/output.

An additional scheme to possibly prevent these adverse outcomes could involve only introducing the 50% reduction on negative gearing tax concessions on newly purchased property (also known as a grandfather clause). This would mean landlords who currently

benefit from these concessions would not have to increase rent prices to ensure the property is neutrally or positively geared, therefore having no significant effect on either party. The only people disadvantaged by such policy would be prospective investment property buyers.

Research conducted by University of Melbourne economists (Cho, Li, & Uren) in 2018 predicted that abolishing negative gearing would cause 76% of Australian households to be financially better off, house prices would decrease by 1.2%, GDP would increase by 1.5% and home-ownership rates would increase to 72.2%, the highest level since 1991. The report does conceive rent would ‘marginally increase’, and the 1.2% decrease in prices may not be enough. However, reforming negative gearing as well as the CGT and the interest rate may have a greater effect.

In the 1985 negative gearing was removed for two years. Despite its abolishment coinciding with a share market boom leading to an increased aggregate demand, median rent only increased in two capital cities: Perth and Sydney. During this time however, economists believe there was a shortage of rental properties in Perth and Sydney which meant prices were already increasing.

CONCLUSION

Housing affordability is a significant macroeconomic issue that Australia is facing, which will very likely worsen without policy changes. Reducing negative gearing tax concessions would prospectively decrease the price of housing, assisting first-home buyers and others attempting to buy property for non-rental purposes and increasing home-ownership in Australia. It would consequently assist the market in returning to long-term mean price levels and incentivise savers to spend more of their disposable income, promoting economic activity as they would have to save less for a deposit. A 50% reduction in negative gearing tax concessions enforceable only to newly purchased property would be an appropriate policy amendment. Reductions in CGT discounts and phased increases in the interest rate should also be considerations for the federal government and RBA. The FHSS scheme is yet to be instigated such that economists can gauge its effect, although it may not be a suitable policy change to improve housing affordability for first home buyers and the general public. Furthermore, the aforementioned reduction in negative gearing tax concessions would increase the federal government’s tax receipts, improving budgetary position which is currently a deficit. With the appropriate policy amendments as stated above, Australia’s macroeconomic issue of housing affordability can prospectively be improved.

Reference list

ABC Fact Check. (2016, March 3). Fact check: Did abolishing negative gearing push up rents? Retrieved from http://www.abc.net.au/news/2015-05-06/hockey-negative gearing/6431100

Agarwal, P. (2018, January 30). Equal Distribution of Income. Retrieved from https://www.intelligenteconomist.com/equitable-distribution-of-income/

Australian Bureau of Statistics (ABS). (2009 - 2018). Data and statistics. Retrieved from www.abs.gov.au/

Ballantyne, A. (2017, June 15). What would happen if negative gearing was abolished? Retrieved from https://www.realestate.com.au/news/what-would-happen-if-negative-gearing-was-abolished/

Berry, M., & Dalton, T. (2004). Housing prices and policy dilemmas: a peculiarly Australian problem? Urban Policy & Research, 22(1), 69-91. Retrieved from Routledge.

Chalmers, S. (2018, January 18). Household debt 'extremely elevated' after hitting near 200pc and tipped to grow. Retrieved from http://www.abc.net.au/news/2018-01 18/household-debt-extremely-elevated-and-tipped-to-grow/9340880

Chang, C. (2016, May 17). What happened last time we messed with housing? Retrieved from http://www.news.com.au/finance/real-estate/what-happened-last-time-we messed-with-housing/news-story/ad060b7d2557bd382f4bba5d1fa9ca98

Cho, Y., Li, S. M., & Uren, L. (2017, November 17). Negative Gearing and Welfare: A Quantitative Study for the Australian Housing Market. University of Melbourne, Preliminary, 24-36. Retrieved from Reserve Bank of Australia.

Commonwealth Bank of Australia (CBA). (2017, July 6). What is negative gearing? Retrieved from https://www.commbank.com.au/guidance/property/negative-gearing-and-tax-201605.html

Coorey, P. (2017, February 15). Plan to cut capital gains tax discount for property investors, not negative gearing. Retrieved from http://www.afr.com/news/policy/plan-to-cut capital-gains-tax-discount-for-property-investors-20170215-gudwdc

Danielle Wood, John Daley (2016, April 26). Reducing the capital gains tax discount is an easy win. Why is the government ignoring it? Retrieved from https://www.theguardian.com/commentisfree/2016/apr/26/reducing-the-capital-gains tax-discount-is-an-easy-win-why-is-the-government-ignoring-it

Doherty, B. (2018, January 13). Home ownership would rise if negative gearing is scrapped, study says. Retrieved from https://www.theguardian.com/australia news/2018/jan/13/australian-house-prices-will-fall-if-negative-gearing-goes-study says

Flood, J. (2016). Price elasticity of demand and rising house prices. Retrieved from http://esacentral.org.au/images/JoeFlood.pdf

Fox, R., & Finlay, R. (2012). Dwelling Prices and Household Income. Retrieved from Reserve Bank of Australia.

Fry, R. A., Martin, V. L., Voukelatos, N., & (2009). Overvaluation in Australian Housing and Equity Markets: Wealth Effects or Monetary Policy? University of Melbourne, Retrieved from Editorial Express Database.

Garner, A. (2006). Should the Decline in the Personal Saving Rate Be a Cause for Concern? https://www.kansascityfed.org/pTTSn/PUBLICAT/EconRev/PDF/2Q06garn.pdf

Hancock, J. (2017, April 26). Housing affordability: Negative gearing forcing up house

prices, not land shortage as Property Council suggests, expert says. Retrieved from http://www.abc.net.au/news/2017-04-26/negative-gearing-increasing-house-prices expert-says/8473374

Janda, M. (2017, September 20). House prices overvalued by up to 30pc in Australia's biggest cities: economist. Retrieved from http://www.abc.net.au/news/2017-09 20/house-prices-overvalued-by-up-to-30pc-in-biggest-capitals/8965150

John Daley, Brendan Coates (2017, March 22). Using superannuation to pay for housing: a bad idea that refuses to die. Retrieved from https://www.theguardian.com/australia news/2017/mar/22/using-superannuation-to-pay-for-housing-a-bad-idea-that-refuses to-die

Mousina, D. (2017, May 8). Australian housing affordability crisis – can government policies fix the problem? Retrieved from http://www.ampcapital.com.au/article detail?alias=/site-assets/articles/latest-news/australian-housing-affordability-crisis

N.A. (2017). What Percentage (%) Of Australians Own Investment Property? Retrieved from http://onproperty.com.au/percentage-of-australians-own-property/

Pash, C. (2018, January 18). Australia's household debt is now one of the highest in the world. Retrieved from https://www.businessinsider.com.au/australias-household-debt is-now-one-of-the-highest-in-the-world-2018-1

Powell, G. (2017, May 1). Perth housing prices drop amid excess supply after mining boom. Retrieved from http://www.abc.net.au/news/2017-05-01/perth-has-weakest-real estate-market-in-australia/8485386

Rahman, M. M. (2008). Australian Housing Market: Causes and Effects of Rising Price. School of Accounting, Economics and Finance, 8-11. Retrieved from University of Southern Queensland.

Woodall, P. (2004, November 17). Home truths. Retrieved from https://www.economist.com/node/3373325

Written by Ted S on 2 May 2018

Muchas gracias. ?Como puedo iniciar sesion?

That’s a great read! Love this economics content. Will help with business decisions.